The fast food industry has been wringing its hands over the devastating impact on its business from California’s new minimum wage law on its workers.

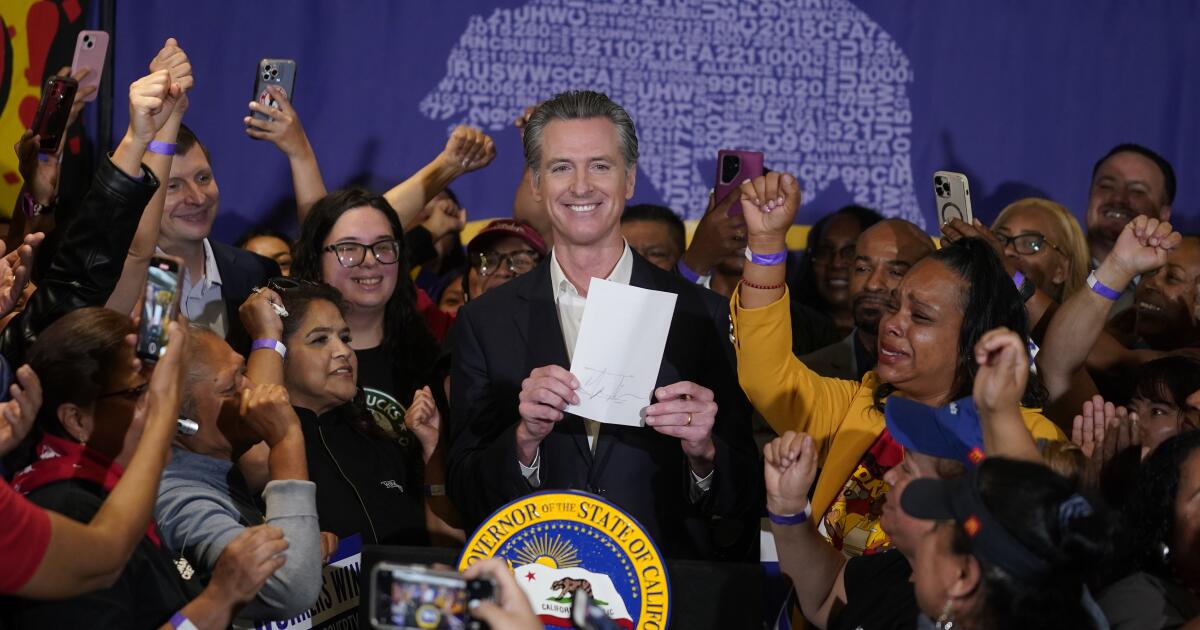

Their raw numbers certainly bear this out. A full-page ad recently placed in USA Today by the California Business and Industry Alliance claimed that about 10,000 fast food jobs had been lost in the state since Gov. Gavin Newsom signed the law into law in September.

The ad listed a dozen chains, from Pizza Hut to Cinnabon, whose local franchisees had cut jobs or raised prices, or are considering taking those steps. According to the ad, the chains were “victims of Newsom’s minimum wage,” which raised the minimum wage at fast food to $20 from $16, effective April 1.

Rapid job cuts, price hikes and business closings are a direct result of Governor Newsom and this short-sighted legislation.

– Business lobbyist Tom Manzo, touting misleading statistics

Here’s something you might want to know about this claim. It’s thick-sliced baloney. In fact, from September to January, the period covered by the ad, fast-food employment in California has is stick, as tracked by the Bureau of Labor Statistics and the Federal Reserve. The claim that it has fallen represents a blatant misrepresentation of government employment figures.

Something else the ad doesn’t tell you is that after January, fast-food employment continued to grow. As of April, employment in the limited-service restaurant sector that includes fast food establishments was nearly 7,000 jobs higher than it was in April 2023, the month before Newsom signed the minimum wage bill.

Newspaper

Get the latest from Michael Hiltzik

Commentary on the economy and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

Despite this, the job loss numbers and finger-pointing at the minimum wage law have spread across the business press and conservative media, from the Wall Street Journal to the New York Post to the website of the conservative Hoover Institution.

We’ll take a closer look at the intelligence of corporate lobbyists that makes job gains look like job losses. But first, a quick walkthrough of the economic landscape of fast food in general.

Few would argue that the restaurant business is easy, whether we’re talking about high-end dining, kiosks and food trucks, or franchised fast food chains. The cost of labor is among the many expenses that owners have to deal with, but the last few years are far from the worst. This would be inflation in the cost of food.

Newport Beach-based Chipotle Mexican Grill, for example, revealed in its most recent annual report that food, beverage and packaging cost it $2.9 billion last year, down from $2.6 billion in 2022 — though those costs fell as part of income to 29.5%. from 30.1%. Labor costs in 2023 reached $2.4 billion, but fell to 24.7% of revenue from 25.5% in 2022.

At Costa Mesa-based El Pollo Loco, labor and related costs fell last year by $3.5 million, or 2.7%, despite a $4.1 million increase the company attributed to higher minimum wages passed in the past , as well as “competitive pressure” – in other words, the need to pay more to attract employees in a tight labor market.

Then there’s Rubio’s Coastal Grill. On June 3, the Carlsbad chain confirmed it had closed 48 of its California restaurants, about a third of its 134 locations. As my colleague Don Lee reported, Rubio’s attributed the closings to the rising cost of doing business in California.

However, there is more to the story. The biggest expense facing Rubio’s is debt — a burden that has grown since the chain was bought in 2010 by private equity firm Mill Road Capital. By 2020, the chain was $72.3 million in debt and it filed for bankruptcy. Indeed, in its full bankruptcy court filing filed June 5, the company acknowledged that along with the minimum wage hike, it was facing an “unsustainable debt burden.”

The company emerged from bankruptcy in late 2020 with settlements that included a reduction in its debt load. Then came the pandemic, a strong headwind. Among its struggles was again its debt — $72.9 million owed to its largest creditor, TREW Capital Management, a firm that specializes in lending to struggling restaurant businesses. It filed for bankruptcy again on June 5, two days after announcing the store closings. The matter is pending.

Fast food and other restaurant jobs decline annually from fall to January due to seasonal factors (red line); seasonal adjustments (blue line) give a more accurate picture of employment trends. The sharp decline in 2020 was caused by the pandemic.

(Federal Reserve Bank of St. Louis)

It’s worth noting that high debt is often a feature of private equity takeovers—in such cases, loading an acquired company with debt gives buyers a means to get money out of their companies, even if it complicates the path. of companies to profitability. It’s not clear if that’s a factor in Rubio’s recent struggles.

This brings us back to the claim that the job losses at California fast food restaurants are due to the new minimum wage law.

The claim appears to originate from the Wall Street Journal, which reported on March 25 that restaurants across California were cutting jobs in anticipation of the minimum wage increase that would take effect on April 1.

The article said employment in California’s fast food and “other limited-service foods” was 726,600 in January, “down 1.3% from last September,” when Newsom signed the minimum wage law. That resulted in employment of 736,170 in September, for an estimated loss of 9,570 jobs from September to January.

The Journal numbers were used as a primer by UCLA economics professor Lee E. Ohanian for an article he published April 24 on the website of the Hoover Institution, where he is a senior fellow.

Ohanian wrote that the pace of fast-food job losses was far greater than the overall decline in private employment in California from September to January, “making it tempting to conclude that many of those lost jobs in fast-food resulted from the highest level of labor costs employers will have to pay” when the new law began.

CABIA cited Ohanian’s article as the source for its claim in its USA Today ad that “nearly 10,000” fast-food jobs were lost because of the minimum wage law. “Rapid job cuts, price hikes and business closures are a direct result of Governor Newsom and this short-sighted legislation,” says CABIA founder and president Tom Manzo on the organization’s website.

Here’s the problem with this figure: it’s derived from a government statistic that isn’t seasonally adjusted. This is essential when tracking jobs in seasonal industries, such as restaurants, because their business and therefore employment fluctuates in predictable patterns throughout the year. For this reason, economists often prefer seasonally adjusted numbers when determining employment trends in those industries.

The Wall Street Journal figures correspond to non-seasonally adjusted figures for fast food employment in California released by the Bureau of Labor Statistics. (I’m indebted to the inimitable financial blogger Barry Ritholtz and his colleague, alias Invictus, for bringing this issue to light.)

Figures for fast food restaurants in California from the Federal Reserve Bank of St. pink in the September-January period with 6,335 jobs, from 736,160 to 742,495.

That’s not to say there haven’t been job cuts this year by some fast-food chains and other companies in the hospitality industries. From the point of view of laid-off workers, the manipulation of statistics by their employers does not ease the pain of job loss.

However, as Ritholtz and Invictus point out, it is the economy that the proper way to deal with non-seasonally adjusted figures is to use year-over-year comparisons, which avoid seasonal trends.

Doing this with California fast food statistics gives us a different picture than CABIA paints. In that business sector, employment in September rose from a seasonally adjusted 730,000 in 2022 to 741,079 in 2024. In January, employment rose from 732,738 in 2023 to 742,495 this year.

Restaurant lobbyists can’t pretend they’re unfamiliar with the concept of seasonality. It has been a familiar feature of the business since, like forever.

Restaurant consultant Toast even offers advice to restaurant owners on how to manage the phenomenon, noting that “April through September is the busiest time of the year,” mainly because that period includes Mother’s Day and Father’s Day, ” two of the restaurant’s busiest days of the year,” and because good weather encourages customers to eat outside more often.

What is the slowest period? November through January, “when many people travel for holidays like Thanksgiving or Christmas and spend time cooking and eating with family.”

In other words, the lobbyists, the Journal and their followers all based their expressions of concern on a well-known pattern in which restaurant employment peaks in September and then declines by January — every year.

They chose to blame California’s minimum wage law, which had nothing to do with it. One cannot see into their hearts and souls, but under such circumstances their arguments seem more than a little cynical.

The author of the Wall Street Journal article, Heather Haddon, did not respond to my question about why she seemed to use non-seasonally adjusted figures when adjusted figures were more appropriate. Tom Manzo, CABIA’s founder and president, did not respond to my request for comment.

Ohanian acknowledged by email that “if the data is not seasonally adjusted, then no conclusions can be drawn from that data regarding AB 1228,” the minimum wage law. He said he interpreted the Wall Street Journal’s figures as seasonally adjusted and said he would ask the Journal about the issue pending a write-up later this summer.

He noted, quite rightly, that the bill’s labor cost increase was huge and that “if franchisees continue to face large increases in food costs later this year, then the industry is going to really struggle.” Fast food companies have already imposed significant price increases to cover their higher costs, he noted. “This begs the question of how sensitive fast food consumers are to higher prices,” a topic he says he will research as the year goes on.